CNBC has dusted off their “Global Market Sell-Off” graphic and the market’s “fear gauge” – the VIX – has risen to its highest level since March of 2020. Let’s not forget that bad news sells! This brings to mind the famous Warren Buffett quote, “be fearful when others are greedy and to be greedy only when others are fearful.” While we don’t necessarily think now is the time to be greedy, we do think this is an important time to remind you that big, short-term swings in the market can and will happen. What’s important to remember is we’re not day traders or short-term investors – we invest for the long-term and stick to our plan. There could be more pain ahead – if you haven’t been paying attention there is no shortage of geopolitical risk or the elections quickly approaching in November – or Jerome Powell could step in with a rate cut and we snap back to all-time highs similar to March of 2020. It would be very advantageous if we had that crystal ball, but without that luxury, we grind on. Some of our most important work as advisors comes when things get ugly, and people get fearful or emotional. We wanted to send a few reminders of why it’s important to not let the day-to-day market moves cause you to lose sleep.

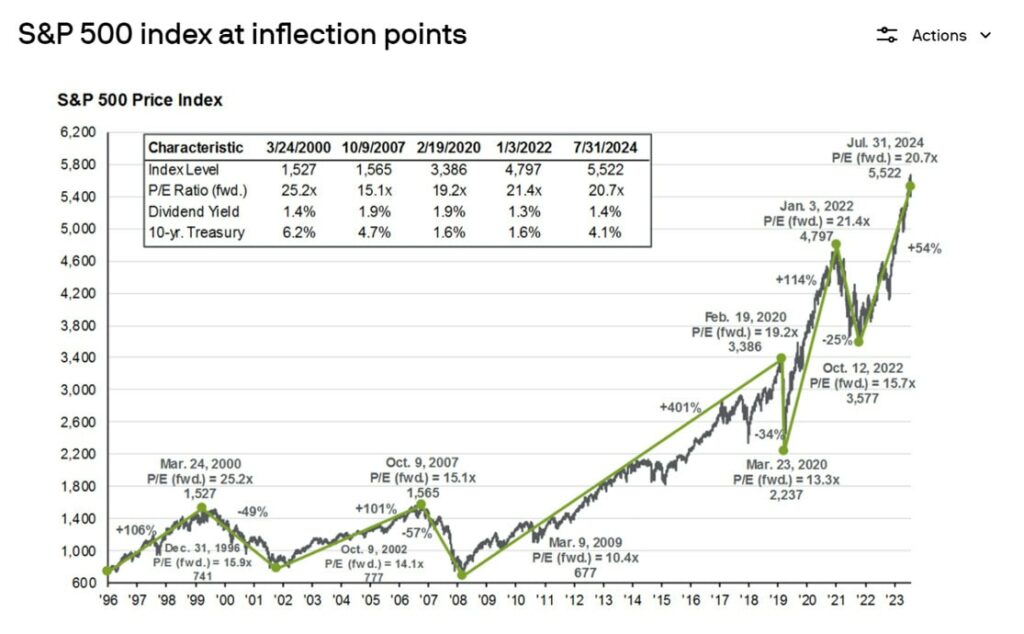

“When in doubt, zoom out.” There was plenty of fear in the markets during the tech bubble, the global financial crisis, Covid and many other times in between. One of the most important parts of investing is perspective, and without a long-term perspective investors can get stuck in the mud of the headlines.

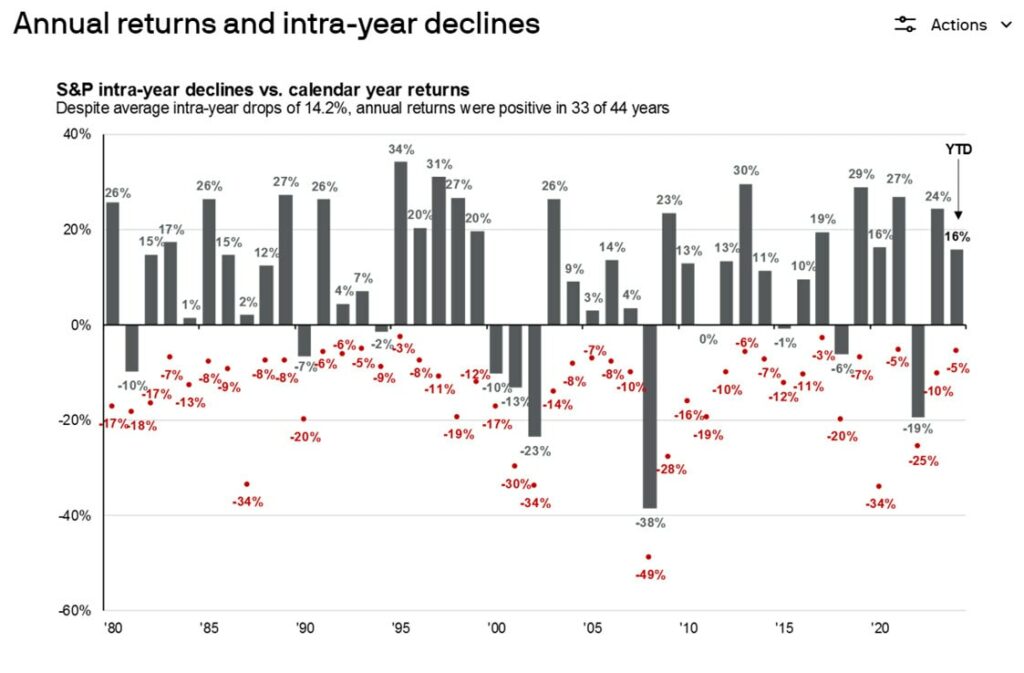

This is one of our favorite charts that is often forgotten when things are running smoothly. Pullbacks in the market happen more often than investors realize and, in some cases, actually create great buying opportunities. The average pullback going back to 1980 is 14.2%, despite the market being positive 33 of those 44 years. 2024 has been a relatively smooth year thanks to the outperformance of a few mega-cap tech stocks, but we haven’t really seen the volatility or pullback that is typical intra-year.

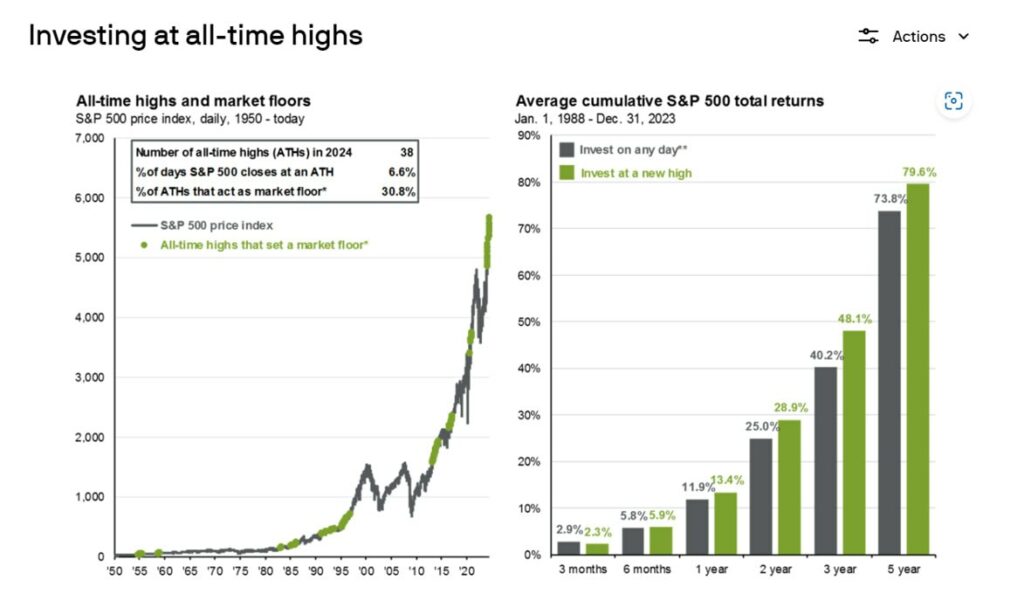

“Buy low, sell high”, great in theory, but very hard to do. Waiting on the sidelines for too long can be much more painful in the long run than short-term volatility. When do you sell? When do you get back in? Even the best investors of all-time cannot do this with any consistency. The most important resource we have in both life and investing is time.